In 1930, U.S. Congress passed the Smoot-Hawley Tariff Act, with the hopes of calming the great depression, and to raise more revenue for the federal government. To paraphrase the great...

Kuala Lumpur, 28 November 2024 – Since the announcement of Act 852 regulations by the Ministry of Health (MOH), the retail industry has pleaded for the government to be sensitive...

WASHINGTON, D.C. – As the next Congress takes shape following President Trump’s electoral victory and Republican control of both the Senate and House being solidified, there is likely to be...

Washington, D.C. – The Consumer Choice Center (CCC) expresses deep concern over the DOJ’s proposed remedy in the case of United States v. Google LLC that would force the tech firm sell off...

This week, I received a letter from an employer of mine from when I was in high school, a local car wash. It turns out there was a “data breach”...

Canadians are now planning for the holidays, they are figuring out how to get the best deals on a particularly tight budget for all the Christmas gifts they have to...

Washington, D.C. – The Consumer Choice Center today launched its policy primer offering simple reforms to provide for more competitive, reasonable, and accurate insurance rates to increase choice and lower...

Washington, D.C. – Today the Consumer Choice Center launched its policy primer offering simple reforms to provide Americans with more competitive, reasonable, and accurate insurance rates. The result of reform...

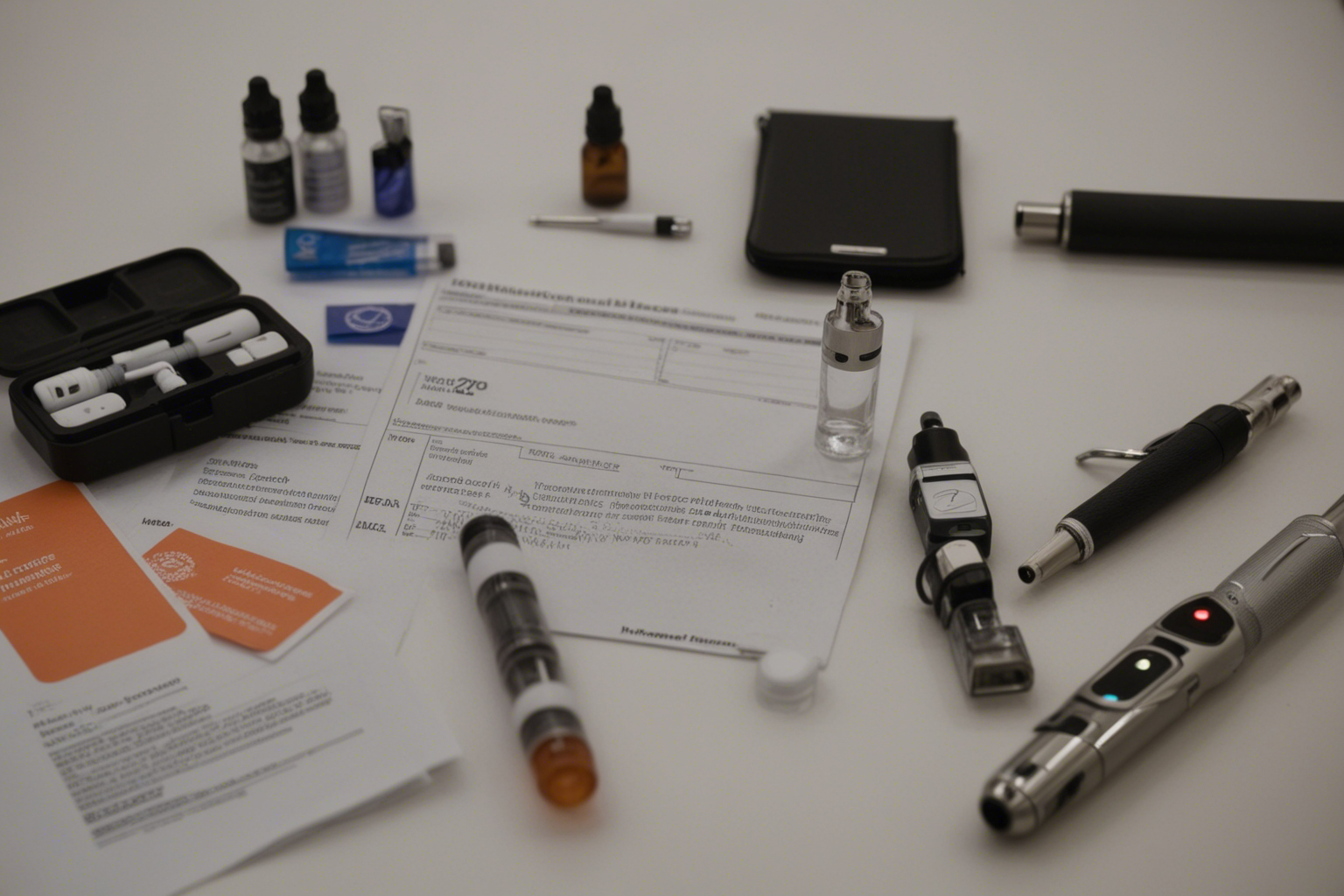

The French Health Minister Geneviève Darrieussecq’s announcement to ban nicotine pouches disregards a valuable tool in the fight against smoking-related disease and, by extension, undermines consumer choice and public health....

Many Ontarians are celebrating the new rules that allow them to buy alcohol at big box stores like Costco and at their local convenience store, a practice other provinces and...

THE UK government introduced its Tobacco and Vapes Bill in Parliament today, aiming to create a “smoke-free generation” by prohibiting anyone born after 1 January 2009 from legally purchasing cigarettes...

The history of the LCBO is rife with the contradiction of making money off a social vice they take pride in suppressing, and its existence is based in a sense...