The Price of Fuel is Too Damn High Factsheet: Taxation of EU Motor Vehicles

Introduction

This paper aims to show in which EU countries the drivers of internal combustion engine cars enjoy the most freedom and which are most burdened by taxes. The vast share of mobility costs in most EU member states arise from taxes and duties. In this paper, we focus on personal motor vehicles (passenger cars). We look at registration fees in the European Union, as well as the incoming ban of motor vehicle sales. We argue that the government share in the price of petrol and diesel is excessively high, and that it is critical that the EU embraces technology neutrality.

Motor vehicle owners face acquisition (VAT, registration), ownership, and motoring (fuel) taxes and the amount varies from country to country. VAT on buying cars in the EU ranges between 17-27%, with Luxembourg having the lowest and Hungary the highest tax rates. Interestingly enough, VAT is charged on the sales value of petrol and diesel.

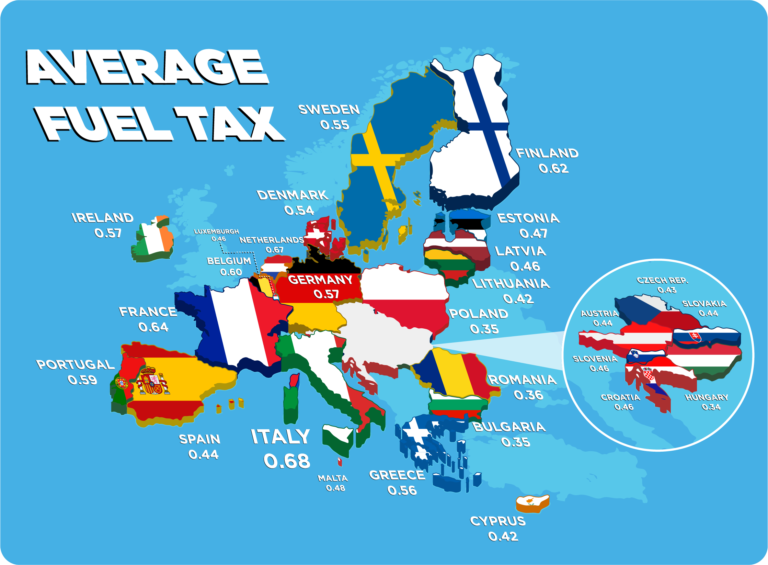

Petrol, causing more CO2 emissions, is taxed higher than diesel in all countries but Hungary. Hungary, along with Romania, has the lowest average tax duty on fuel, while Italy, followed by the Netherlands and France has the highest.

To prevent competitive distortions, the EU has a minimum excise duty rate set that its members are required to apply to all energy products. Overall, on average the government share on fuel price varies between 44-59%.

HIGH REGISTRATION FEES

Registration fees vary from country to country and are intertwined with registration taxes. Bulgaria, Estonia, Germany, Latvia, Luxembourg and Romania are the only countries where motor vehicle registration fees are fixed. In all remaining countries’ registration fees/taxes are calculated based on car value, fuel efficiency or CO2 emissions. Sweden happens to be the only country not charging any type of registration fee/tax. 11 out of 27 EU member states charge CO2 based taxes on buying the car.

Denmark has the highest registration tax rate, which is calculated based on the taxable value of the car (“taxable value of the car is defined as the dealer’s sale price including profit margin of at least 9% (minimum for dealer and importer combined profit) and VAT”). Registration tax goes up as high as 150% of the vehicle’s taxable value, if the value exceeds €27,174. Tax-related complications of purchasing a vehicle could explain why the number of vehicles per capita in Denmark is similar to that of Eastern European countries.

Countries with similar GDP per capita have an average number of 563 while in Denmark it’s 480 vehicles per 1000 people. Car insurance that is mandatory by law is also taxed at 25% and for each day you drive an uninsured car you will have to pay around 33 Euros, and if you happen to be stopped by police you will be fined around €134.

The EU should embrace technology neutrality

Arguments can be made for and against both electric and internal combustion engine vehicles. But the most important discussion point here is that by banning the sales of motor vehicles, the European Union is favouring one type of technology over the other. This is the wrong course of action, especially in the light of the current slow deployment of charging stations and disparity in their availability between EU countries. The choice should be up to consumers and if companies detect a new trend of increased demand for EVs, they will voluntarily shift the manufacturing process towards EVs. Neither the EU or any other government body should be mandating or endorsing one specific technology.

To preserve consumer choice and foster future innovation, governments must strictly adhere to technology neutrality and avoid decreeing winners and losers. Sometimes the best thing to do is to just sit back and observe, without interfering, and allowing consumers to make the choice that will eventually win out.