Washington, D.C. – The Consumer Choice Center today launched its policy primer offering simple reforms to provide for more competitive, reasonable, and accurate insurance rates to increase choice and lower...

Washington, D.C. – Today the Consumer Choice Center launched its policy primer offering simple reforms to provide Americans with more competitive, reasonable, and accurate insurance rates. The result of reform...

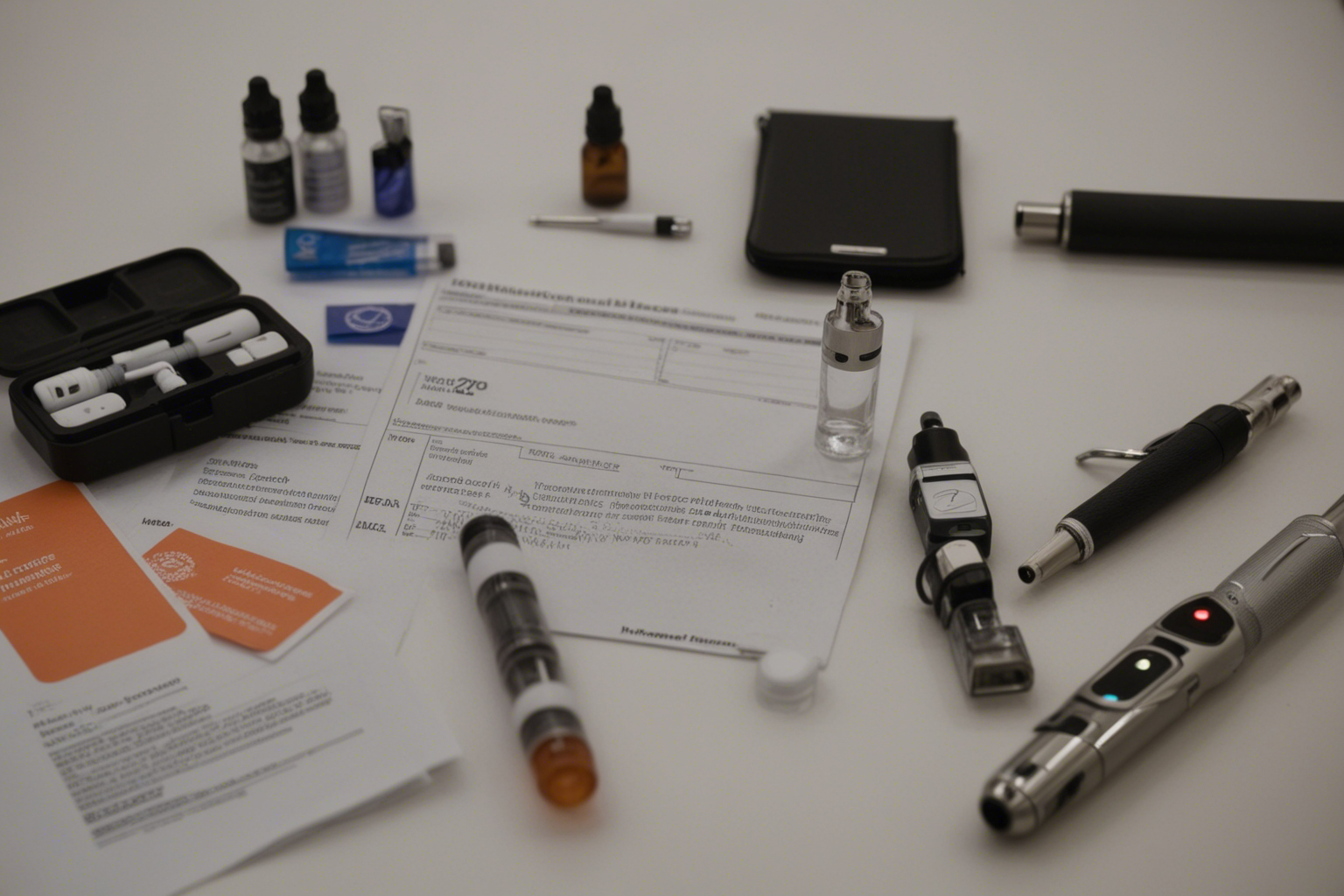

The French Health Minister Geneviève Darrieussecq’s announcement to ban nicotine pouches disregards a valuable tool in the fight against smoking-related disease and, by extension, undermines consumer choice and public health....

Many Ontarians are celebrating the new rules that allow them to buy alcohol at big box stores like Costco and at their local convenience store, a practice other provinces and...