On March 24, 2023, following through on his campaign pledge to address lawsuit abuse and mounting insurance costs, Florida Governor Ron DeSantis signed HB 837 into law, providing for changes to civil liability, attorneys’ fees, limits on damage rewards, and more.

The intent of this law is in line with recent tort reforms enacted in states such as Mississippi and Texas, reserving civil liability courts for more serious harms while reducing the incentive or opportunity for more superficial cases to advance through the legal system.

For proponents, the logic of these reforms is to try to avoid unnecessary, frivolous, or trumped-up lawsuits while keeping the system open for those who are legitimately harmed. This maintains and supports civil justice while avoiding the vastly ballooning costs in legal budgets and insurance claims that must inevitably be passed on to consumers.

Reformers believe liability reforms should curb excesses to protect the rights of citizens and consumers, all the while reducing the “tort tax” to save on costs.

Opponents, however, view liability reforms as handouts to big businesses and insurance companies, depriving consumers of their ability to sue and locking ordinary people out from using legal remedies in taxpayer-funded courts.

The stricter definitions of liability and negligence, in addition, are viewed by tort attorneys and their supporters as ways to narrow responsibility when mishaps, accidents, or calamities occur.

Now that Florida’s HB 837 has been in place for two years, what have been the impacts of this civil liability reform? Most importantly, what does the liability lawfare reform mean for consumers and the businesses and entrepreneurs that hope to serve them? Are they better or worse off?

In this policy primer, we will examine preliminary data that demonstrate the law’s positive impacts, including reducing the state’s overall litigiousness, stabilizing prices, and delivering lower costs to consumers.

In the introduction to his seminal textbook on tort reform, distinguished law professor Andrew Popper notes that “whether one is involved in litigation or one has never been and hopes never to be part of a lawsuit or even see the inside of a courtroom, tort reform is of consequence because it touches on fundamental forces affecting our day-to-day lives.”

In the introduction to his seminal textbook on tort reform, distinguished law professor Andrew Popper notes that “whether one is involved in litigation or one has never been and hopes never to be part of a lawsuit or even see the inside of a courtroom, tort reform is of consequence because it touches on fundamental forces affecting our day-to-day lives.”

Whether it be an insurance contract, a restaurant, or a house you rent on vacation, liability or tort law impacts every type of business and the consumers who rely on it.

The types of cups at a cafe, the locks installed by landlords at an apartment, or the clauses found within a property insurance policy are deliberately designed and informed by liability and consumer protection laws. When lawsuits happen and a party is alleged to be liable for an injury or harm, those factors are taken into account, as well as the facts of the case.

And while civil justice law has created the framework for businesses and consumers to manage risk and solve disputes, it has also opened the door for meritless lawsuits or claims that seek maximum rewards, especially if the party being sued happens to have deep pockets, gold-plated insurance policies, or a ticker on the stock market.

This is aggravated by the fact that in the American legal system, there is no “loser pays” model, meaning that even if a plaintiff loses a case against a defendant, no matter how frivolous, defendants cannot recoup their legal costs. This makes litigiousness a costly affair for both individuals and firms, and often increases the incentive to elevate lawsuits no matter the merit.

For the purposes of our analysis, we refer to this as liability lawfare, the strategic deployment of liability claims and tort law as a weaponized legal tactic to achieve objectives beyond mere compensation for actual harms.

Sophisticated websites and marketing campaigns aim to recruit potential clients for large class action lawsuits against major brands and companies, alleging everything from privacy violations to falsely labeled “natural” products.

This “race to the courthouse” has been aided and abetted by a cadre of highly skilled liability and injury “billboard” attorneys who make a lucrative living recruiting plaintiffs and seeking payouts, estimated to be a $27 billion industry in Florida alone.

While many of these attorneys may represent clients with legitimate grievances and documented instances of harm, there is an industry of lawyers marketing their ability to extract massive rewards that dwarf any original insurance or medical claim.

Through a network of favorable medical offices and expert witnesses, attorneys are able to demand record-level payouts far beyond the actual damages or costs claimed, whether paid out-of-pocket or by an insurance company.

A January 2025 racketeering lawsuit filed in New York against a series of injury firms, doctors offices, and pain management clinics by rideshare firm Uber alleges a wide-ranging fraudulent scheme intended to exploit auto accident victims by pushing unnecessary medical procedures to exaggerate claims in hopes of larger settlements by insurance.

Such allegations, if proven true, demonstrate the direct impact that abuse of the legal system has on consumers and the businesses and insurers that cater to them, and appropriately places these reforms in a context where any civic-minded advocate would hope to enact them.

Practically, these reforms have generally meant caps on non-economic damages, adjustments in joint and several liability rules, stricter requirements on standing, shorter statutes of limitation, and special protections for healthcare providers and businesses that take effective precautions for health and safety.

The state of Florida has always been a hotbed for civil justice abuse, earning it the title of “Number 1 Judicial Hellhole” in 2018 and second place in 2019 by the American Tort Reform Foundation. It has consistently been in the top 10 for at least the last decade.

The state of Florida has always been a hotbed for civil justice abuse, earning it the title of “Number 1 Judicial Hellhole” in 2018 and second place in 2019 by the American Tort Reform Foundation. It has consistently been in the top 10 for at least the last decade.

Some of the nation’s largest personal injury and mass torts legal firms are based in Florida, making the state’s court systems some of the busiest in the country. Over 2 million civil lawsuits are filed in Florida each year, and nearly a quarter are in Miami-Dade County alone. The biggest categories of civil lawsuits are contract disputes and auto accidents, making up nearly two-thirds of all civil litigation in the state.

From March 2022-2023, a staggering 28,342 personal injury lawsuits were filed in Florida, the most personal injury claims per capita and over 62% of all civil legal actions.

Before 2023, lawsuit “abuse” was estimated to cost Florida households more than $5,000 a year, impacting up to 173,000 jobs annually, causing a significant impact on various industries that impact everyday people, namely property insurance, hospitals, restaurants, construction, rental agencies, and much more.

This became very evident in the fallout from rising litigation and ballooning claims in the property insurance market after the record storms in 2021 and 2022, so much so that a special legislative session was convened in December 2022 to pass drastic reforms. The legislative fix cracked down on “assignment of benefits” between housing contractors and trial lawyers that allowed them to chase down insurance companies via courts rather than ordinary claims. It is noteworthy that property insurance litigation costs shot up to nearly $3 billion between 2016 and 2021.

This provides the context for HB837, and why Governor DeSantis made legal reform such a big part of his re-election campaign.

The contents of HB837 offer sweeping liability lawfare changes aimed at reducing costs for ordinary people:

Once HB837’s liability reforms were signed into law, a record 100,000 new lawsuits were filed in the five days before it went into effect, totaling 280,122 in March alone, demonstrating the change of the state of play in liability law.

In our analysis, we will use four primary indicators to gauge the success of Florida’s liability lawfare reform, taking into consideration the short time horizon and the lagging indicator of civil cases filed in state courts.

The first will be in tracking insurance rates, the second will be in the transparency on actual paid versus advertised medical spending in liability disputes, third will be the amount of new civil litigation since the reforms were passed, and the fourth indicator will be measuring innovation by new market entrants, mostly in insurance.

One of the biggest stinging points for Florida residents has been the historical price of property insurance. Because of the increased risk of damage caused by hurricanes, floods, and other weather events, property insurance rates have always historically been high in the Sunshine State. That’s the price of paradise.

Florida also has a unique property insurance market structure due to the state-run Citizens Property Insurance Corporation (CPIC), an “insurer of last resort” established in 2002 that aims to insure homeowners otherwise unable to get coverage from the private market. Nearly 1.3 million Floridians have a policy through CIPC, which further distorts the market by crowding out private insurance policies.

Despite the moral hazard implicit with a state-run insurer, Florida’s unique vulnerability to weather conditions and expensive real estate make it a more expensive market for insurance consumers.

As mentioned above, another unique driver in insurance cost inflation is the amount of litigation around claims and reconstruction. Rather than dealing through the claims process themselves, many homeowners opted to hire attorneys to sue for claims above the limits of their policies, something curbed in Gov. DeSantis’ 2022 reforms and also reformed by HB837.

With all these data points, Florida has consistently ranked in the top 5 of most expensive property insurance markets in the country, nestled near the tornado-prone states of Oklahoma, Kansas, and Nebraska and other hurricane-prone states like Louisiana and Texas.

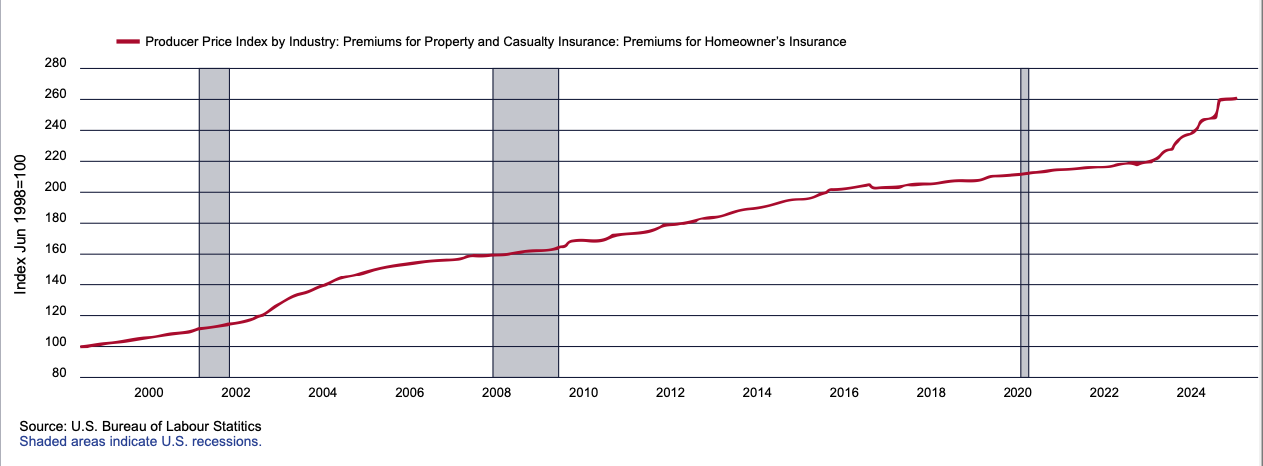

Added to this, there has also been a general trend toward increasing property and home insurance for some time. Increasing risk from climate change, severe weather, inflation in building materials, and litigation costs. The US Treasury estimates that home insurance has risen by more than 8.7 percent above inflation since 2018, seen in the Bureau of Labor Statistics data tracing back to the year 2000.

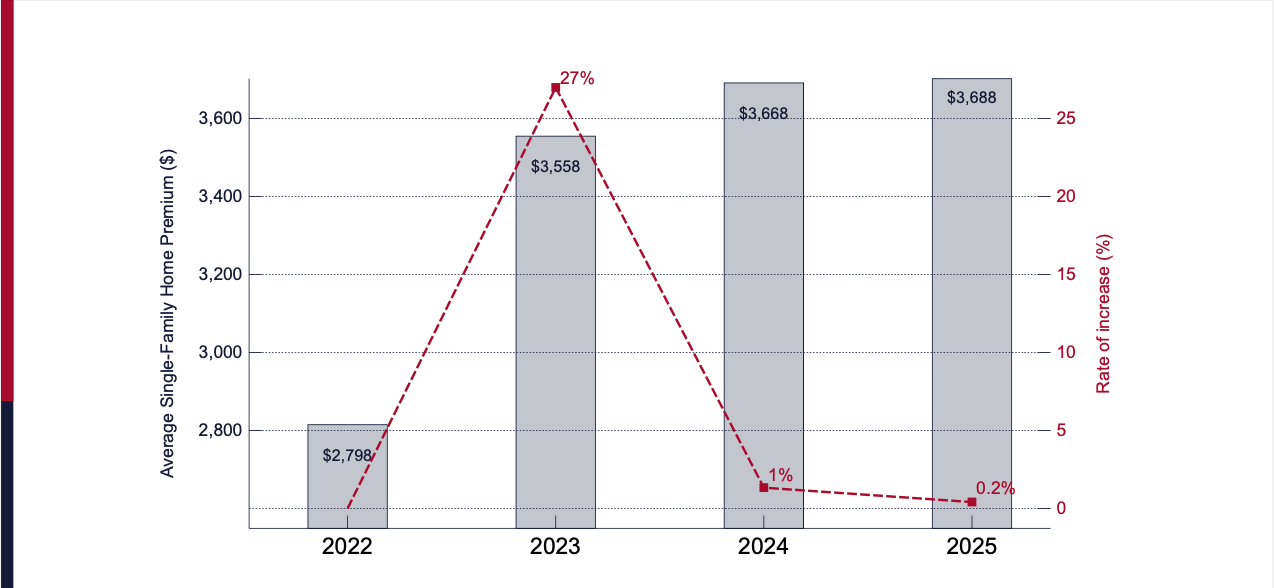

However, thanks to the reforms of HB837, as well as a number of other insurance and legal reforms signed into law by Gov. DeSantis, there is a quantifiable reduction and stabilization of insurance premiums for the time being.

According to a 2024 S&P Global Market Intelligence survey, Florida had the lowest calculated weighted average increase in home insurance at just 1%, compared with the whopping rise of more than 20% in states like Iowa, Minnesota, Montana, Nebraska, Utah, and Washington.

Even though a modest rise will be expected later in the year, once claims are calculated from storm damage, this still represents a significant achievement for Florida insurance consumers.

What’s more, data from the Florida Office of Insurance Regulation shows that in 2025 over 20% of Citizens Property Insurance Corporation policyholders will have an average of 5.6% decrease in insurance premiums statewide – most of which are in Miami-Dade County – and more than 477,000 individual policies are moving from the state-run insurer to private insurers, reducing the number of state-insured households to under 1 million for the first time in two years.

These figures demonstrate a more competitive and affordable market for consumers that is stabilizing, rather than increasing, despite the risk from increased storms and hurricanes.

In the field of auto insurance, though the data is preliminary, insurers such as GEICO, Progressive, and State Farm have filed for insurance rate reductions of 10.5%, 8.1%, and 6%, respectively, marking a dramatic shift from years of increases. Considering the backlog of auto accident-related claims and cases in Florida courts, we can expect this number to decrease going forward.

One larger theme that impacts American patients and consumers is price inflation for both health insurance as well as overall medical expenses. This is made even more complicated and expensive by the presence of “middlemen” in healthcare, including networks of hospital administrators, insurance bureaucracies, pain clinics, federal and state government programs, mandates, subsidies, and much more.

One larger theme that impacts American patients and consumers is price inflation for both health insurance as well as overall medical expenses. This is made even more complicated and expensive by the presence of “middlemen” in healthcare, including networks of hospital administrators, insurance bureaucracies, pain clinics, federal and state government programs, mandates, subsidies, and much more.

A positive reform found in HB837 was the transparency in medical costs that could be presented in liability cases, whether they be auto accidents or workplace accidents.

By requiring plaintiffs to submit the actual cost they paid for their medical treatments in civil trials, rather than the often inflated “sticker prices” or the total billed amount before insurance coverage kicks in, it provides a much more accurate cost figure for judges and juries to consider.

This particular reform requires transparent submission of actual medical costs versus adjusted costs that can easily be exaggerated by unnecessary medical interventions or procedures.

As was noted above in the lawsuit against certain legal firms in New York state, there are alleged organized financial relationships between certain attorneys and medical providers to inflate costs for hopes of much larger rewards or settlements on behalf of clients.

As an example, if a victim is in an auto accident and suffers minor scrapes that cost less than a few thousand dollars to treat, is it appropriate and necessary for months of rehabilitation, psychological evaluations, and pain management clinic visits, as well as hypothetical future costs, to be included in the amount of damages if any reasonable medical professional would consider this treatment excessive?

This perverse incentive has been baked into injury law and exploited by a number of firms who have close financial relationships with medical providers. HB837 aims to curb this practice by requiring transparency and honesty in billing practices, as well as ensuring that plaintiffs are able to recover only admissible costs, rather than inflated amounts that only serve to benefit their attorneys.

This reasonable reform introduces an accountable process that considers victims’ actual medical bills and expenses, rather than a profit-seeking figure that inflates the costs to insurers.

While it is still too early for quantifiable evidence in just two years, this reform has the benefit of protecting the civil justice system by avoiding unnecessary and inflated costs, benefiting consumers who will pay more affordable insurance rates for both healthcare and auto insurance.

Another figure of note is the reduction in the number of active civil litigation cases on the dockets of Florida courts. Though the litigation spike in March of 2023 has skewed proper quantitative analysis, there is still a measurable reduction in the number of cases brought to both county and small claims courts in Florida.

An important reform found in HB837 was the introduction of comparative negligence, properly derisking negligence standards if plaintiffs were also found to be at fault in their case. Most legal analysts have concluded that this standard alone will have a predominant effect on reducing cases brought to court.

By late 2023, county civil dispositions fell 12%, and small claims dropped 27% year-over-year, according to the Florida Office of the State Courts Administrator, marking a staggering drop in civil litigation.

In Marathon Strategies’ annual ranking of “nuclear verdicts” (jury verdicts awarded over $10 million), Florida has also dropped from second place down to seventh, marking a key change in civil litigation rewards.

Data from the specific category of auto glass repair litigation also saw a reduction in the number of cases from 24,720 lawsuits in the second quarter of 2023 to just 2,613 in the same period of 2024.

The last category is innovation, quantified by the number of new market entrants specific to property and casualty insurance.

As noted before, property insurance has consistently been a difficult category for both firms wishing to remain solvent, and consumers hoping for affordable rates.

Considering the influence and size of state-run Citizens Property Insurance Corporation, as well as the high-risk conditions of Florida’s storm conditions and the litigious civil procedures, it has traditionally been difficult to see any new market entrants.

However, since the reforms of HB837 were signed into law in 2023, 10 new property insurers have entered the state to compete for consumers’ business. This includes Mangrove Property Insurance Company, ASI Select Insurance Corp., Trident Reciprocal Exchange, Ovation Home Insurance Exchange, Manatee Insurance Exchange, Condo Owners Reciprocal Exchange, Orange Insurance Exchange, Orion180 Select Insurance Company, Orion180 Insurance Company, Mainsail Insurance Company, and Tailrow Insurance Exchange, as of last count.

As noted by Florida Insurance Commissioner Mike Yaworsky, there are now 18 new entities competing against Citizens Insurance Property Corporation for property insurance policies, leading to yet more options for consumers.

Aided by a more stabilized legal regime, more policyholders transition to the private market in hopes of chasing lower premiums. This will continue to create the demand for new insurers to offer policies in the state, and provide healthy competition with the state’s property insurer of last resort. Overall, this category is on the upswing, and will continue to pay dividends as long as civil reforms continue to hold promise.

The reforms offered in Florida’s HB837 have had a positive impact on reducing ballooning legal costs and impacts to consumers and small businesses.

By implementing a more comprehensive calculation of negligence, requiring transparency in documented medical costs, capping settlement awards, and reforming attorneys’ fees, Florida’s historic 2023 liability lawfare reform has done its part to relieve the civil justice system while keeping it open and available for those who most desperately need it.

Though we can only analyze two years’ worth of data, there is still a general trendline that demonstrates the impact of liability lawfare reform in the state of Florida.

Following the trend of steady insurance rates, transparency in medical costs, reduced litigation, and new innovation and competition spurred by worthwhile reforms, Florida consumers have and will continue to benefit from a sounder justice system that will lead to cost savings over the long run.

The legislature should aim to keep these reforms in place, and provide timely quantifiable updates to citizens and consumers to measure out how they are making a difference.

Deputy Director

Research Director

We will, from time to time, keep you updated on new and troublesome regulations in your country and ways that you can help use fight them. Don’t worry, being a member is always free!